Introduction

Artificial Intelligence (AI) has revolutionized numerous industries, and now it is making waves in the realm of investing. As an investor, I have discovered that harnessing the power of AI can be a game-changer in generating profits and establishing passive income streams.

What is Artificial Intelligence?

At its core, AI refers to machines’ ability to mimic and replicate human intelligence, enabling them to learn, reason, and perform tasks with remarkable accuracy and efficiency. AI algorithms analyze vast amounts of data, uncover patterns, and make predictions based on the insights gained. These capabilities empower investors to make informed decisions and identify lucrative opportunities in the market.

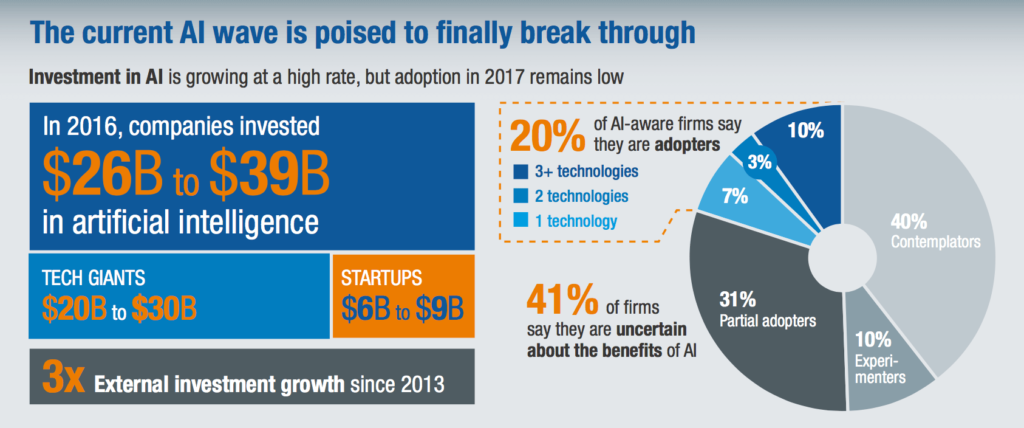

Growing Scope of AI in Investment

AI’s influence in investment strategies expands far beyond traditional quantitative analysis and statistical models. It now encompasses sentiment analysis, natural language processing, and even algorithmic trading. By leveraging AI technology, investors can gain a competitive edge by swiftly interpreting market trends, predicting outcomes, and executing trades with precision.

With the integration of AI, investors have access to sophisticated tools and platforms that offer real-time analytics, portfolio optimization, and risk management solutions. Moreover, AI-powered robo-advisors can provide personalized investment advice tailored to individual goals and risk tolerance.

embracing AI in investing strategies has the potential to unlock profitable opportunities and create passive income streams. Throughout this article, we will explore the various ways in which AI augments investment decision-making and discover how it can be effectively utilized to maximize returns. So, let’s delve into the intriguing world of AI-driven investing strategies!

Understanding AI in Investing

Artificial Intelligence (AI) is revolutionizing the way we approach investing. It offers innovative solutions to maximize profits and generate passive income. In this section, I will delve into two key areas where AI is making a significant impact: AI-Powered Trading Systems and AI for Portfolio Management.

AI-Powered Trading Systems

AI-Powered Trading Systems have transformed the investment landscape. These systems leverage the power of AI algorithms to analyze vast amounts of data in real-time, enabling smarter decision-making and faster execution. By continuously monitoring market trends, analyzing historical data, and identifying patterns, these systems can make precise predictions about the future movement of stocks, currencies, and other financial instruments. This newfound accuracy can greatly enhance investment returns and minimize risks.

AI for Portfolio Management

AI is also reshaping portfolio management strategies. With its ability to analyze complex financial data and optimize investment allocation, AI can effectively manage portfolios and mitigate risks. AI algorithms can evaluate the performance of different asset classes, identify correlations, and make data-driven recommendations to optimize portfolio diversification. Moreover, AI can adapt to changing market conditions, ensuring that the portfolio remains well-balanced and aligned with the investor’s goals.

AI has revolutionized the investment landscape by introducing new and effective strategies. AI-Powered Trading Systems and AI for Portfolio Management can enhance investment returns and minimize risks, leading to increased profitability and passive income. Harnessing the power of AI in investing is a game-changer for investors, offering them a competitive edge in the market.

Building an AI Investment Strategy

Artificial Intelligence (AI) has revolutionized various industries, and investing is no exception. By leveraging AI technology, investors can gain a competitive edge in the market and potentially generate substantial profits. In this section, I will discuss how to build an effective AI investment strategy and make money through passive income.

Identifying Investment Opportunities with AI

One of the key advantages of using AI in investing is its ability to analyze vast amounts of data and identify potential investment opportunities. AI algorithms can sift through financial reports, news articles, and social media sentiments to detect patterns and trends that humans might overlook. By utilizing such AI tools, investors can make informed decisions and select the most promising assets for their portfolios.

Evaluating Risks and Uncertainties

While AI can provide valuable insights, it is essential to evaluate the risks and uncertainties associated with any investment. AI models are not infallible and can be subject to biases or inaccuracies in their predictions. As an investor, it is crucial to critically assess the recommendations provided by AI systems and consider other factors such as market conditions and industry-specific risks.

building an AI investment strategy involves identifying investment opportunities through AI-powered tools and carefully evaluating risks and uncertainties. By incorporating AI into our investment approach, we can increase our chances of success and potentially generate passive income in the constantly evolving financial landscape.

Types of AI Investment Strategies

Investing in artificial intelligence (AI) has become increasingly popular in recent years, thanks to its potential to generate profits and passive income. There are various types of AI investment strategies that investors can consider when looking to capitalize on this emerging technology. In this article, I will discuss two prominent strategies: quantitative trading and machine learning-driven investing.

Quantitative Trading Strategies

One effective approach in AI investing is quantitative trading. This strategy involves using mathematical models and statistical analysis to make investment decisions. By leveraging algorithms, investors can analyze vast amounts of data and identify trading opportunities that humans may overlook. These algorithms consider factors such as historical market data, news sentiment, and technical indicators to predict market movements accurately. With AI-powered tools, investors can execute trades swiftly and efficiently, maximizing their potential for profitability.

Machine Learning-Driven Investing

Another strategy that has gained popularity is machine learning-driven investing. This approach involves using machine learning algorithms to make investment decisions based on patterns and trends in data. Machine learning models can analyze large datasets and identify patterns that humans might miss. By continuously learning and adapting, these models can generate insights and recommendations to optimize investment portfolios. Machine learning-driven investing can be particularly useful in areas such as stock selection, risk management, and portfolio optimization.

AI offers investors the opportunity to generate profits and passive income through different strategies. Whether utilizing quantitative trading approaches or machine learning-driven investing, AI can enhance decision-making and potentially lead to more successful investment outcomes. So, consider incorporating AI into your investment strategy and take advantage of its immense potential for profit.

AI-Powered Stock Selection

Artificial Intelligence (AI) has revolutionized the way we approach investing, offering new opportunities for profit and passive income. One of the key ways to leverage AI in investing is through AI-powered stock selection strategies. By using advanced algorithms and machine learning techniques, AI can analyze vast amounts of stock data and make predictions about their future performance.

Using AI to Analyze Stock Data

AI-powered tools can analyze a wide range of data points, such as financial statements, news articles, social media trends, and market sentiment. By processing this information, AI algorithms can identify patterns and correlations that are beyond human capabilities. This enables investors to make data-driven decisions based on real-time insights, improving their chances of success in the market.

Predictive Analytics for Stock Selection

Predictive analytics is a powerful application of AI in stock selection. By combining historical data with current market conditions, AI algorithms can forecast future stock prices with a high degree of accuracy. This allows investors to identify undervalued stocks or anticipate market trends, increasing their chances of making profitable investments.

With AI-powered stock selection, investors can eliminate emotions and human biases from their decision-making process. They can rely on objective data analysis to identify opportunities and manage risks effectively. By integrating AI into their investment strategies, individuals can maximize their profit potential and create a sustainable source of passive income.

AI in Personalized Wealth Management

As an investor, I am always on the lookout for new ways to maximize my profits and generate passive income. One strategy that has caught my attention recently is utilizing Artificial Intelligence (AI) in personalized wealth management. The potential that AI holds for the investment world is immense, and it is important to understand how we can leverage this technology to our advantage.

AI Assistants for Wealth Management

One of the ways AI can benefit investors is through the use of AI assistants. These assistants can analyze vast amounts of data and provide personalized investment recommendations based on an individual’s financial goals and risk tolerance. By utilizing AI assistants, investors like me can make smarter investment decisions and achieve better returns.

Robo-Advisors and AI Guidance

Another popular application of AI in wealth management is the use of robo-advisors. These platforms leverage AI algorithms to automate investment strategies and provide guidance based on predetermined investment principles. Robo-advisors offer a cost-effective and time-efficient way to manage investments, making them an attractive option for both novice and experienced investors.

leveraging AI in personalized wealth management has the potential to revolutionize the way we invest and generate passive income. By utilizing AI assistants and robo-advisors, investors can benefit from accurate and personalized investment recommendations. So why not consider incorporating AI into your investment strategy and profit from its capabilities?

Benefits and Challenges of AI Investing

Artificial Intelligence (AI) has revolutionized various industries, including finance and investing. As an investor, I have discovered the numerous benefits of integrating AI into my strategies. AI enables enhanced decision-making processes and increases efficiency, leading to the potential for higher profits and passive income. However, it is essential to acknowledge the challenges and ethical considerations associated with this technology.

Enhanced Decision Making and Efficiency

By harnessing the power of AI, investors can analyze vast amounts of data and generate actionable insights. This enables me to make well-informed and timely investment decisions. AI algorithms can process and interpret data faster and more accurately than humans, reducing the risk of costly errors and maximizing profit potential. Additionally, AI-powered tools and platforms streamline investment processes, freeing up time for me to focus on other aspects of my portfolio.

Ethical Considerations and Human Oversight

While AI offers tremendous advantages, it is crucial to exercise human oversight and consider ethical implications. AI algorithms are only as good as the data they are trained on; biases in data can result in biased investment decisions. As an ethical investor, I actively monitor the responsible use of AI in my investment practices. Ultimately, human judgment and ethics should guide the deployment and outcomes of AI-driven investment strategies, ensuring fairness, transparency, and accountability.

Incorporating AI into my investment approach has unlocked new opportunities for profit and passive income. By leveraging AI’s enhanced decision-making capabilities and increased efficiency, I have witnessed tangible benefits in my investment returns. However, it is essential to remain mindful of the challenges and ethical considerations associated with this powerful technology.”

Conclusion

In conclusion, harnessing the potential of artificial intelligence (AI) in investment can be a game-changer for those looking to make money and generate passive income. By leveraging AI technologies, investors can gain valuable insights into market trends, forecast future movements, and make data-driven investment decisions.

Harnessing the Potential of AI in Investment

AI has the ability to analyze vast amounts of data at lightning speed, uncovering patterns and correlations that may not be readily apparent to human investors. This technology can provide a competitive edge by identifying profitable investment opportunities and minimizing risks.

By utilizing AI-based tools, such as machine learning algorithms and predictive analytics, investors can make more informed decisions and optimize their portfolios for greater returns. These tools can analyze historical market data, identify patterns, and make accurate predictions about future trends, enabling investors to stay ahead of the curve.

Embracing the Future of Profitable Investing

Investors who embrace AI for profit can potentially enjoy significant advantages in the investment world. With the ability to process large volumes of data quickly and accurately, AI can help identify emerging sectors and disruptive technologies with high growth potential.

Furthermore, AI can also assist in portfolio management by continuously monitoring market conditions and adjusting investment strategies accordingly. This adaptive approach allows investors to capitalize on market opportunities and mitigate risks in real-time.

In conclusion, incorporating AI into investment strategies is not only a smart move but a necessary one in today’s fast-paced and data-driven financial landscape. By harnessing the power of AI, investors can potentially unlock previously untapped profit opportunities and secure long-term financial success.