Introduction

Welcome to “Unlocking Potential: AI-driven Opportunities in Fintech.” In this article, I will delve into the exciting world of Artificial Intelligence (AI) in the financial technology sector and explore the opportunities it presents for making money and generating passive income.

Defining AI in Fintech

First, let’s clarify what AI in Fintech actually means. AI refers to the development of computer systems capable of performing tasks that would typically require human intelligence. Fintech, on the other hand, stands for financial technology, which encompasses various applications and services that leverage technology to deliver financial products and services.

The Rise of AI in the Financial Industry

In recent years, AI has gained significant traction in the financial industry. Its application spans from automating repetitive tasks, such as data entry and customer support, to sophisticated algorithms that can predict market trends and detect fraud patterns. As financial institutions strive to improve efficiency and customer experience, they are increasingly turning towards AI solutions.

The fusion of AI and Fintech has unlocked a host of opportunities for individuals looking to make money and generate passive income. One such opportunity is through investing in AI-driven fintech companies or funds that specialize in the development and deployment of cutting-edge technologies. By getting in on the ground floor of these innovations, investors can potentially reap substantial returns.

Moreover, AI offers the potential for individuals to develop their own AI-driven fintech solutions. From creating intelligent chatbots to developing predictive analytics tools, there are countless ways to leverage AI and meet the demand for smarter financial services.

In the following sections, we will explore specific avenues for making money and passive income with AI in Fintech. So, let’s dive in and unlock the potential of this exciting combination of technologies.

Exploring the Potential of AI in Fintech

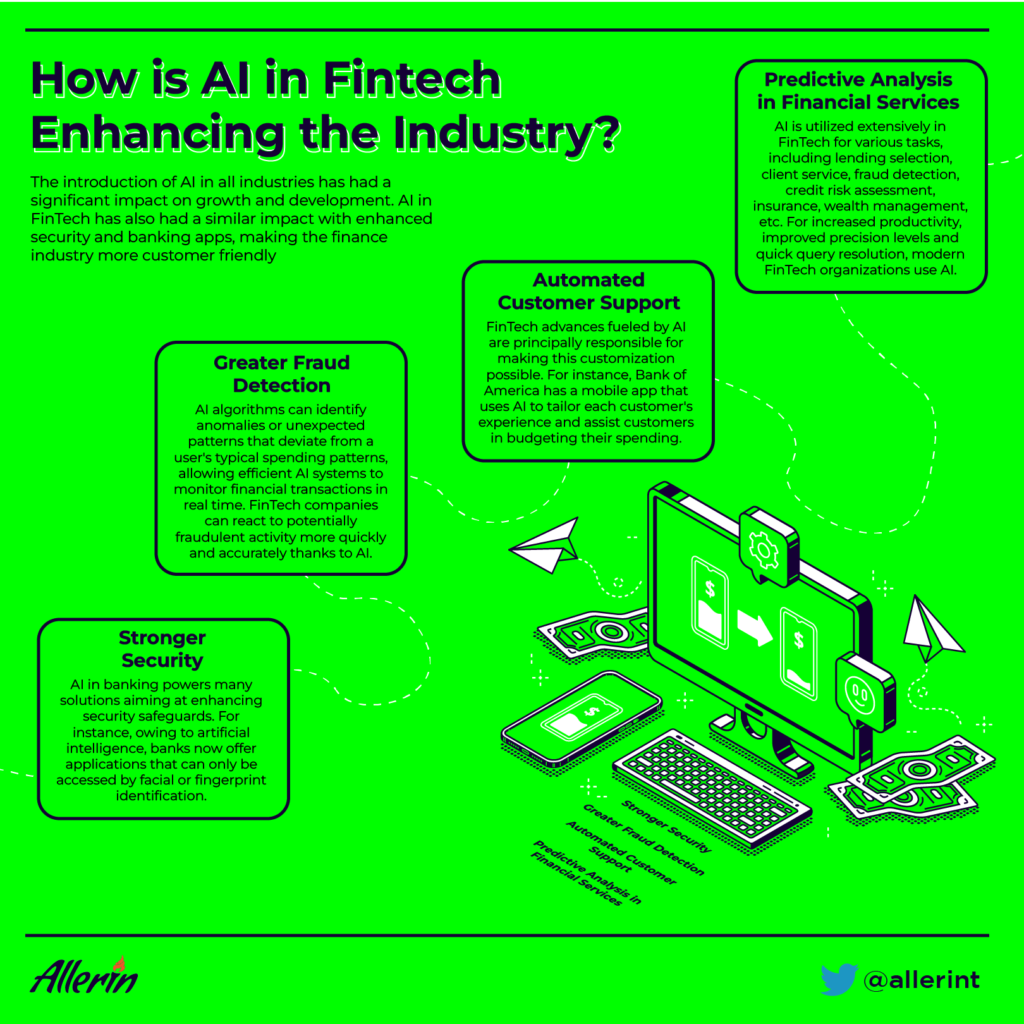

As technology continues to evolve, the world of finance is also adapting to meet the demands of a digital era. The fusion of Artificial Intelligence (AI) and Financial Technology (Fintech) has unlocked numerous opportunities, revolutionizing the way we handle our finances. In this article, I will discuss three key areas where AI-driven opportunities are transforming the fintech landscape: enhancing customer experience and personalization, improving fraud detection and security measures, and automating financial processes and tasks.

Enhancing customer experience and personalization

AI algorithms can analyze vast amounts of data to understand customer behaviors, preferences, and needs. This enables financial institutions to provide personalized recommendations and products tailored to each individual. By offering customized financial solutions, AI technology improves customer satisfaction and builds stronger relationships between banks and their clients.

Improving fraud detection and security measures

AI-powered systems can detect patterns and anomalies in real-time, allowing for faster and more accurate fraud detection. By continuously analyzing transactions and user behavior, AI algorithms can identify suspicious activities and help prevent financial losses. This enhances security measures and safeguards both businesses and customers.

Automating financial processes and tasks

AI automation streamlines manual and repetitive financial processes, such as data entry and reporting, reducing operational costs and human errors. It also enables faster loan approvals, credit assessments, and investment strategies by leveraging machine learning algorithms. By automating these tasks, financial institutions can improve efficiency and provide faster services to their customers.

AI-driven opportunities have the potential to revolutionize fintech in several ways. From enhancing customer experience and personalization to improving fraud detection and security measures, and automating financial processes and tasks, the fusion of AI and fintech is opening new doors for financial institutions and customers alike.

AI-driven Opportunities in Customer Experience

The rapid advancements in artificial intelligence (AI) have opened up countless opportunities in the financial technology (fintech) industry. One area where AI is revolutionizing the way businesses operate is customer experience. With the power of AI, companies can now enhance their interactions with customers, resulting in improved satisfaction and increased revenues.

Implementing chatbots for 24/7 customer support

Gone are the days when customers had to wait on hold for assistance. AI-powered chatbots are now being used by fintech companies to provide 24/7 customer support. These virtual assistants are capable of handling a wide range of inquiries, from basic account information to complex financial advice. By implementing chatbots, businesses can ensure that their customers receive prompt and accurate assistance at any time of the day, enhancing the overall customer experience.

Utilizing AI-powered virtual assistants for personalized recommendations

AI can also help fintech companies offer personalized recommendations based on customer preferences and financial goals. By analyzing vast amounts of data, AI-powered virtual assistants can provide tailored suggestions for investment opportunities, budgeting strategies, and financial planning. This not only helps customers make informed decisions but also strengthens their trust in the company’s expertise. Consequently, businesses can increase customer satisfaction and loyalty, ultimately driving their revenue growth.

In today’s competitive fintech landscape, companies must harness the power of AI to unlock new possibilities in customer experience. By implementing chatbots for 24/7 customer support and utilizing AI-powered virtual assistants for personalized recommendations, businesses can improve customer satisfaction, drive revenue growth, and stay ahead in this rapidly evolving industry.

AI-driven Opportunities in Fraud Detection

With the rise of artificial intelligence (AI), there are countless opportunities for its application in the field of finance and technology, commonly known as FinTech. One such area that has seen significant advancements is fraud detection. AI has the potential to revolutionize the way we identify and prevent fraudulent activities, ultimately preserving the integrity of financial institutions.

Enhancing fraud detection algorithms with AI

AI can enhance fraud detection algorithms by leveraging its advanced analytics and predictive capabilities. Traditional algorithms often rely on predefined rules and patterns to identify potential fraud. However, AI can take this a step further by continuously learning from vast amounts of data and adapting to evolving patterns of fraudulent behavior. By combining historical data, machine learning algorithms, and AI-driven models, financial institutions can significantly improve their fraud detection accuracy.

Utilizing machine learning to identify patterns and anomalies

Machine learning, a subset of AI, is particularly effective in identifying patterns and anomalies in financial transactions. By analyzing large volumes of data, machine learning algorithms can identify suspicious activities that may go unnoticed by human analysts. For example, AI can detect unusual transaction patterns, such as a sudden increase in the frequency or value of transactions, which may indicate fraudulent activity. By automating this process, financial institutions can proactively identify and mitigate potential fraud risks.

the integration of AI into fraud detection processes opens up new possibilities for financial institutions to combat the ever-evolving landscape of fraud. With enhanced algorithms and machine learning capabilities, AI-driven solutions can help protect the integrity of financial systems and safeguard the interests of individuals and organizations alike.

AI-driven Opportunities in Automation

With the rapid advancements in artificial intelligence (AI) technology, the financial technology (fintech) industry is experiencing unprecedented opportunities for growth and innovation. AI has the potential to revolutionize the way we automate routine financial tasks and streamline complex processes, ultimately driving efficiency and profitability. In this post, I will explore the AI-driven opportunities in automation within the fintech sector.

Automating routine financial tasks and processes

AI can be used to automate repetitive and time-consuming tasks in the financial industry. For instance, it can automatically process transactions, reconcile accounts, and generate reports, freeing up valuable time for financial professionals to focus on more strategic initiatives. By eliminating manual errors and reducing operational costs, AI-powered automation can greatly enhance productivity and profitability.

Streamlining loan approvals and underwriting processes with AI

Another significant opportunity lies in the automation of loan approvals and underwriting processes using AI. Through the analysis of vast amounts of financial data, AI algorithms can accurately assess credit risk, evaluate loan applications, and provide real-time decisions, significantly reducing the time and effort required for traditional underwriting. This not only enhances the overall customer experience but also improves the efficiency of lenders, resulting in faster loan approvals and increased profitability.

AI-driven automation in fintech presents immense opportunities for efficiency and profitability. By automating routine tasks and streamlining complex processes, organizations can unlock their full potential and stay ahead of the curve in this rapidly evolving industry. Embracing AI-driven automation will not only improve financial operations but also drive growth and success in the highly competitive fintech landscape.

Challenges and Limitations of AI in Fintech

Ethical considerations and data privacy

When it comes to incorporating AI into the fintech industry, there are a number of challenges and limitations that need to be addressed. One of the primary concerns is the ethical implications surrounding the use of AI in making financial decisions. As AI algorithms become more sophisticated and capable of making complex judgments, it is crucial to ensure that these decisions are fair, unbiased, and in the best interest of the customers.

Another significant challenge in implementing AI in fintech is data privacy. As financial institutions collect vast amounts of personal data, it is essential to prioritize the security and protection of this information. AI algorithms must be designed in a way that safeguards against data breaches and maintains strict privacy standards.

Ensuring transparency and accountability in AI algorithms

Transparency and accountability are two crucial factors in the successful integration of AI in fintech. Customers need to understand how AI algorithms are used to make financial decisions and how their data is being processed. Additionally, financial institutions must be accountable for the actions of their AI systems, taking responsibility for any errors or biases that may arise.

By addressing these challenges and limitations, the fintech industry can unlock the full potential of AI. Ethical considerations, data privacy, transparency, and accountability must be at the forefront of AI-driven fintech solutions, ensuring a fair and secure financial landscape for all.

The Future of AI in Fintech

With the rapid advancements in technology, the future of AI in the financial technology sector, commonly known as Fintech, holds immense potential for groundbreaking opportunities. As an AI enthusiast myself, I am excited to explore the emerging trends and developments that are transforming the landscape of financial services.

Emerging trends and developments

AI-powered algorithms have revolutionized the way we approach financial decision-making. From personalized investment advice to fraud detection, AI has enabled the automation of complex processes that were once exclusively human-driven. This has not only saved time and resources but has also led to more accurate and efficient outcomes.

Collaboration between humans and AI in the financial sector

Contrary to popular belief, AI is not here to replace humans; instead, it complements our skills and expertise. By leveraging AI technologies, financial institutions can make better-informed decisions, providing customers with tailored solutions. The collaboration between humans and AI ensures a more inclusive, adaptive, and customer-centric approach to financial services.

the future of AI in Fintech is promising. The combination of advanced algorithms and human intelligence opens up a vast array of opportunities for both individuals and businesses. From enabling more personalized services to streamlining operations, AI-driven solutions have the potential to unlock new horizons in the financial technology sector. So, let’s embrace this technological revolution and ride the wave of AI-driven opportunities in Fintech.

Conclusion

Realizing the full potential of AI in the fintech industry

In conclusion, the rapid advancements in AI technology are opening up exciting opportunities in the world of fintech. By harnessing the power of AI, companies in this industry can streamline operations, enhance customer experiences, and develop innovative financial products and services.

Through the use of AI algorithms, fintech companies can effectively analyze vast amounts of financial data, identifying patterns and trends that would be impossible for humans to detect. This enables them to make more accurate predictions, automate processes, and ultimately drive profitability.

Expanding opportunities for innovation and growth

Furthermore, AI-driven fintech solutions have the potential to revolutionize the way we manage our personal finances. With smart algorithms and machine learning capabilities, these technologies can offer personalized financial recommendations, identify potential investment opportunities, and even automate savings.

This not only simplifies and streamlines the financial management process for individuals, but also presents new avenues for entrepreneurs to develop AI-driven applications that cater to specific financial needs and preferences.

In conclusion, as AI continues to evolve and mature, the fintech industry stands to gain immense benefits from its integration. By embracing AI-driven opportunities, companies can unlock new levels of innovation, efficiency, and growth, creating a future where finance becomes more accessible, personalized, and intelligent.